The S&P 500 is a stock market index. It shows the performance of 500 large companies. These companies are in the United States. When people talk about the stock market, they often mean the S&P 500.

What is the S&P 500?

The S&P 500 is a list of big companies. These companies are important to the economy. The S&P stands for Standard & Poor’s. This is the group that made the list. The 500 means there are 500 companies on the list. The S&P 500 is a way to see how well the stock market is doing.

Why is the S&P 500 Important?

The S&P 500 is important because it helps people understand the economy. When the S&P 500 goes up, it means many companies are doing well. This is good for the economy. When it goes down, it means companies may not be doing well. This can be bad for the economy.

How is the S&P 500 Calculated?

The S&P 500 is calculated by looking at the stock prices of the 500 companies. Each company has a different value. Some companies are bigger and more important. These companies have a bigger impact on the S&P 500.

Factors Affecting The S&p 500

- Company Performance: How well a company is doing affects its stock price.

- Economic Events: Things like elections or new laws can change the market.

- Global Issues: Problems in other countries can affect the S&P 500.

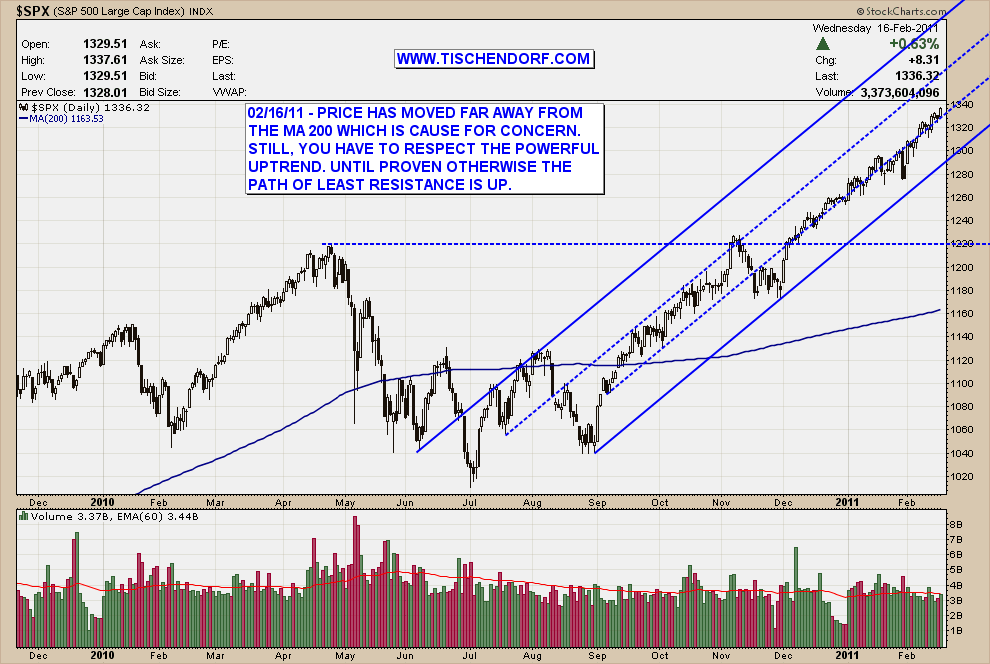

How to Read the S&P 500

Reading the S&P 500 is simple. If the number goes up, the market is doing well. If it goes down, the market is not doing well. People look at the S&P 500 every day. They want to know how the market is doing.

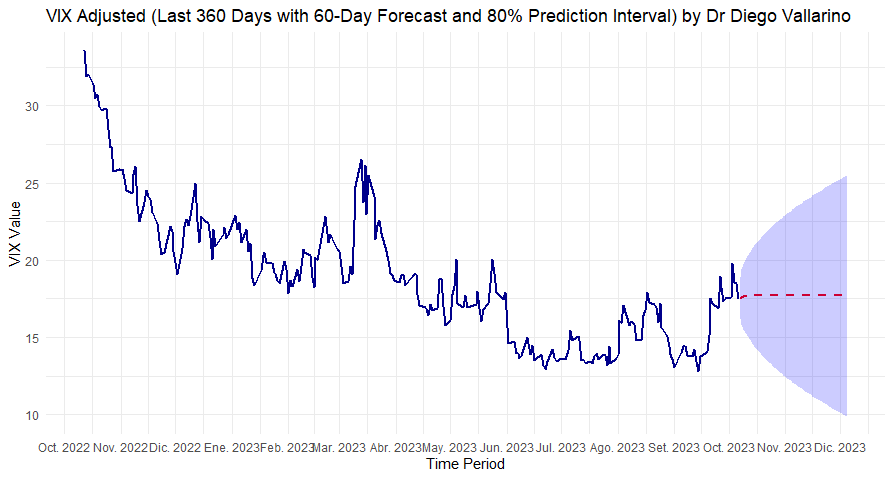

Current Trends in the S&P 500

Today, the S&P 500 is watched closely. Many people are interested in the market. They want to know if the market is strong or weak.

Recent Changes

Recently, some companies have done well. This has helped the S&P 500 go up. But, not all companies are doing well. Some are struggling. This can make the S&P 500 go down.

What To Expect

It is hard to predict the S&P 500. Many things can change the market. But, experts watch the trends. They try to guess what will happen next.

Investing in the S&P 500

Many people invest in the S&P 500. They buy stocks in the companies on the list. This can be a good way to make money. But, it can also be risky. The market can go up and down.

Why Invest In The S&p 500?

- Diversification: Investing in many companies spreads risk.

- Long-Term Growth: Over time, the market tends to go up.

- Market Representation: The S&P 500 covers many industries.

Risks Of Investing

Investing always has risks. The market can change quickly. A company might do poorly. This can make the stock price drop.

Frequently Asked Questions

What Is The S&p 500?

The S&P 500 is a stock market index. It tracks 500 large U. S. companies.

How Is The S&p 500 Calculated?

It is calculated using market capitalization. Bigger companies have more weight.

Why Is The S&p 500 Important?

It reflects the health of the U. S. economy. Investors often use it as a benchmark.

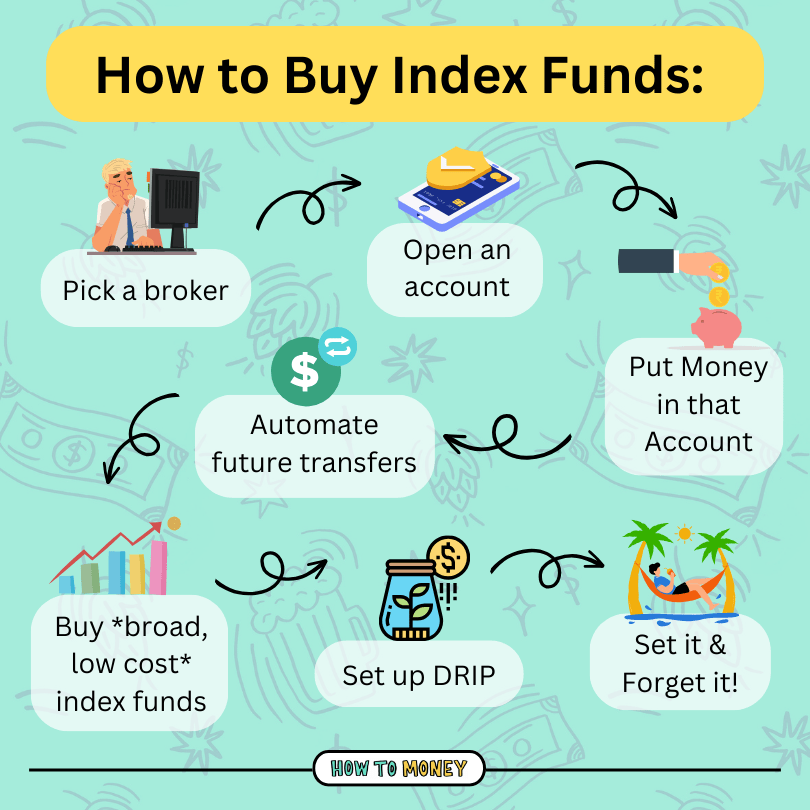

How Can I Invest In The S&p 500?

You can invest through index funds or ETFs. These track the S&P 500 closely.

Conclusion

The S&P 500 is a key part of the stock market. It tells us how big companies are doing. This helps us understand the economy. Watching the S&P 500 can help investors make decisions. It is important to know the trends. This helps us be ready for changes.

Summary

| Topic | Details |

|---|---|

| What is the S&P 500? | A list of 500 large U.S. companies. |

| Importance | Shows the health of the economy. |

| Calculation | Based on stock prices of companies. |

| Trends | Can change daily. Influenced by many factors. |

| Investing | Can be rewarding but involves risk. |

Understanding the S&P 500 is important. It helps us make informed choices. Whether you are investing or just curious, keep an eye on it. The S&P 500 is a window into the economy.