Market volatility can sound complex. But, it’s not. Let’s explore what it means.

What is Market Volatility?

Market volatility shows how much prices move. When prices change fast, it’s high. When prices change slowly, it’s low. Think of a roller coaster. It goes up and down quickly. That’s high volatility. A slow train is low volatility.

Why Does Volatility Happen?

Many things cause volatility. News about companies or the world affects it. If people get scared, they sell. This makes prices go down. If they hear good news, they buy. Prices go up. Simple, right?

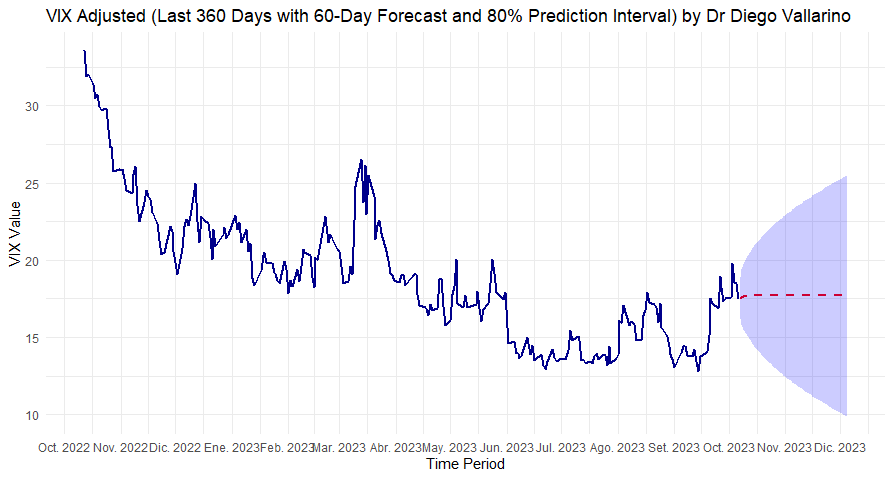

The Importance of Forecasting Volatility

Forecasting helps people prepare. If you know a storm is coming, you grab an umbrella. Similarly, knowing about market changes helps protect money. It helps make smart choices.

Who Needs To Know About Volatility?

- Investors

- Traders

- Companies

- Everyday people

All these people benefit from knowing about volatility. It helps them plan better.

How Do Experts Predict Volatility?

Experts use tools and data. They look at past price changes. They check news and reports. Sometimes, they use computers for help. These methods are like detectives solving a mystery.

Tools For Predicting Volatility

- Charts and Graphs

- News Reports

- Economic Data

- Computer Models

These tools help experts make educated guesses. But remember, they are guesses. Nobody knows the future for sure.

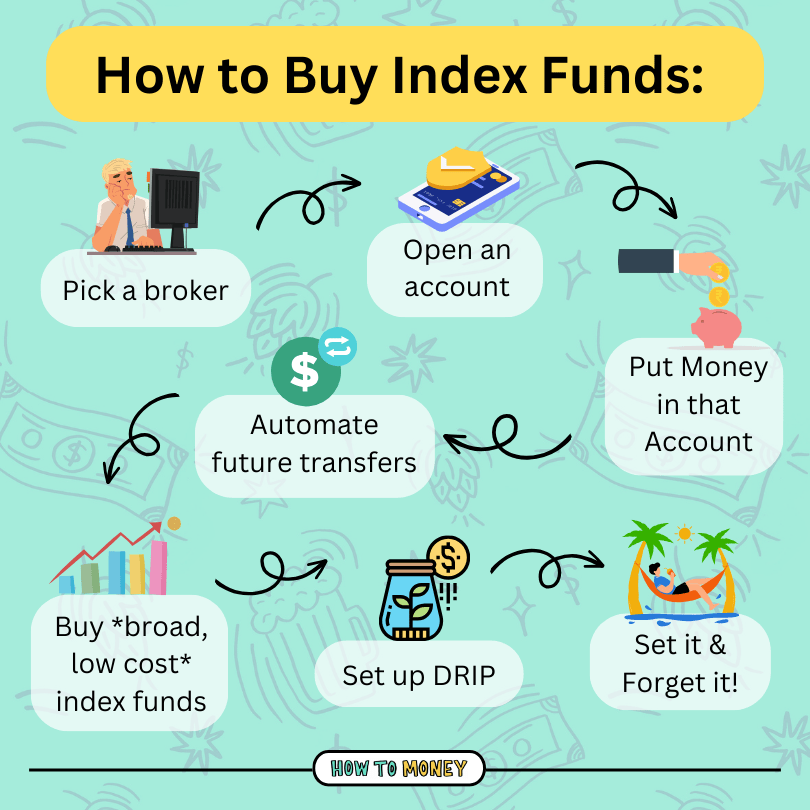

How to React to Market Volatility

Stay calm. Volatility is normal. It’s part of the market. Here are some ways to react:

Steps To Handle Volatility

- Don’t panic. Think before acting.

- Look at the long-term picture.

- Check if your investments match your goals.

- Talk to a financial advisor.

These steps can help make better decisions during volatile times.

Common Misunderstandings About Volatility

Many people think volatility is bad. But it’s not always. It can create chances to buy at lower prices. Or sell at higher prices. Understanding it can help find these chances.

The Role of Emotions in Volatility

Emotions play a big role. Fear and greed can drive decisions. They can make people act without thinking. Staying calm helps avoid mistakes. Remember, emotions can cloud judgment.

Tips To Manage Emotions

- Take deep breaths.

- Think about your goals.

- Talk to someone you trust.

- Don’t rush decisions.

These tips help keep emotions in check during volatility.

Conclusion: Embrace Volatility

Market volatility is not scary. It’s part of investing. By understanding it, you can make better choices. Use the tools and tips discussed here. Learn to see volatility as an opportunity. With practice, you will become more comfortable with market changes. Stay informed and keep learning. This will help you navigate the ups and downs of the market. Remember, knowledge is your best tool against uncertainty.

Frequently Asked Questions

What Causes Market Volatility?

Market volatility is caused by economic events, political instability, and investor speculation. It reflects market uncertainty.

How Can Investors Manage Market Volatility?

Investors can manage volatility by diversifying portfolios, using stop-loss orders, and staying informed about market trends.

Is Market Volatility Good Or Bad For Investors?

Volatility can be both. It offers opportunities for profit but also poses risks. Understanding it is key.

How Does Market Volatility Affect Stock Prices?

Volatility can lead to rapid price changes. It impacts investor sentiment and market stability.