Investing money can seem hard. But, it doesn’t have to be. Index funds are a simple way to start. They are safe and can grow your money over time.

What are Index Funds?

Index funds are a type of investment. They follow a market index. A market index is a group of stocks or bonds. These funds include many different companies. This helps spread risk.

Benefits of Investing in Index Funds

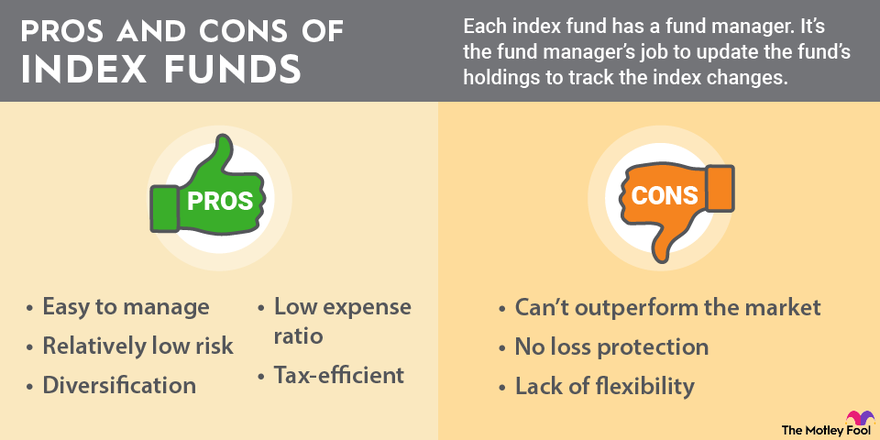

- Low Costs: Index funds are cheap to manage. They do not need a lot of buying and selling.

- Diversification: Your money is spread out. This reduces risk. You don’t put all your eggs in one basket.

- Consistent Performance: They often do well over time. This makes them good for long-term savings.

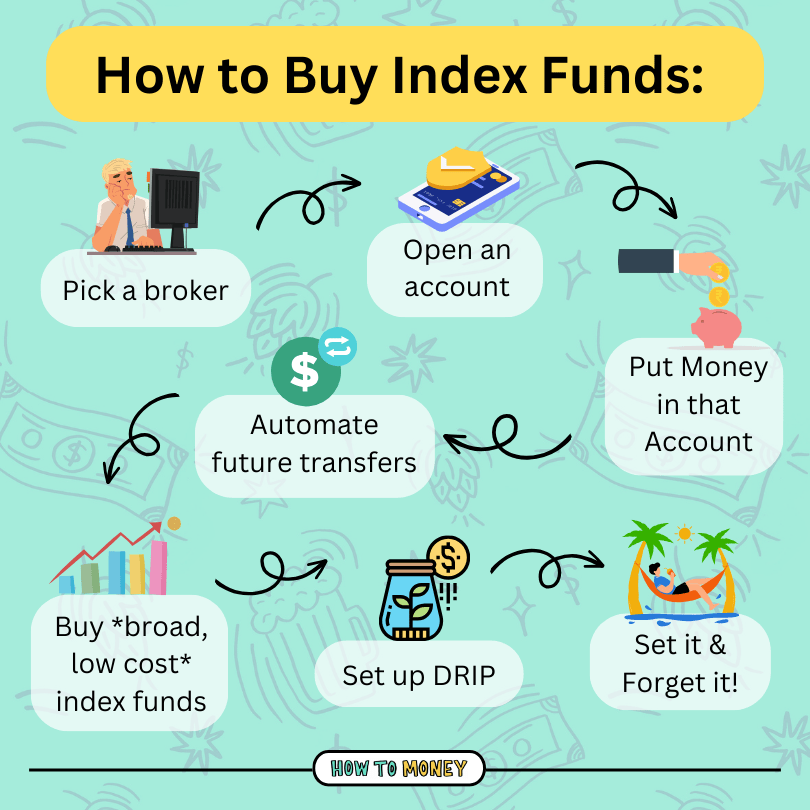

How to Start Investing in Index Funds

Follow these steps to start your journey.

1. Learn And Research

First, learn about index funds. Read articles and watch videos. Understand how they work. This knowledge will help you make good decisions.

2. Choose A Market Index

Next, pick a market index. Common ones are the S&P 500 and the Dow Jones. They include big companies like Apple and Google.

3. Select An Index Fund

Now, choose a fund that follows your chosen index. Look for low fees. Compare different funds to find the best fit.

4. Open An Investment Account

To buy index funds, you need an account. You can open one with a brokerage firm. Some popular ones are Vanguard and Fidelity.

5. Decide How Much To Invest

Think about how much money you want to invest. Start with a small amount. You can add more later.

6. Buy The Index Fund

Use your account to buy the fund. Follow the instructions on the brokerage website. It is usually easy to do.

7. Monitor Your Investment

Check your investment from time to time. See how it is doing. But, do not check too often. Remember, this is for the long term.

8. Stay Patient

Investing takes time. Do not worry about short-term ups and downs. Stay patient and think long-term.

Common Mistakes to Avoid

- Investing Without Research: Always do your homework. Learn before you invest.

- Chasing High Returns: Do not chase quick profits. Slow and steady wins the race.

- Ignoring Fees: Pay attention to fees. High fees can eat into your returns.

Frequently Asked Questions

What Are Index Funds?

Index funds are mutual funds or ETFs that track a specific market index.

How Do Index Funds Work?

They mirror the performance of a market index by holding similar securities.

Why Should I Invest In Index Funds?

They offer diversification, lower costs, and historically stable returns.

What Is The Minimum Investment For Index Funds?

It varies by provider, but some require as little as $500 or less.

Conclusion

Investing in index funds is a smart choice. It is simple and cost-effective. Remember to research, choose wisely, and stay patient. With time, your money can grow.